Non-Profits: Electronic Filing of Form 1024

Taxes

Introduction

Welcome to Ballard & Tronzo Bookkeeping-Tax Service, your trusted partner in non-profit tax services. In this article, we will delve into the intricate process of electronic filing for non-profit organizations using Form 1024.

What is Form 1024?

Form 1024 is the application form used by non-profit organizations to gain recognition of exemption under section 501(c)(4) or 501(c)(6) of the Internal Revenue Code. This form plays an integral role in establishing tax-exempt status for various non-profit entities.

The Benefits of Electronic Filing

Electronic filing of Form 1024 offers numerous advantages for non-profit organizations. Not only does it streamline the application process, but it also eliminates the need for paper-based submissions, reducing potential errors and delays. By opting for electronic filing, non-profits can experience faster turnaround times and greater efficiency in their application for tax-exempt status.

The Electronic Filing Process

When it comes to electronic filing of Form 1024, Ballard & Tronzo Bookkeeping-Tax Service is here to guide you every step of the way. Our team of experts has extensive experience in assisting non-profit organizations in the electronic filing process.

1. Preparing the Application

Before starting the electronic filing process, it is crucial to ensure that all relevant information and documentation are properly organized. Our knowledgeable professionals will work closely with you to gather the necessary data, including details about your non-profit's purpose, activities, and financial status.

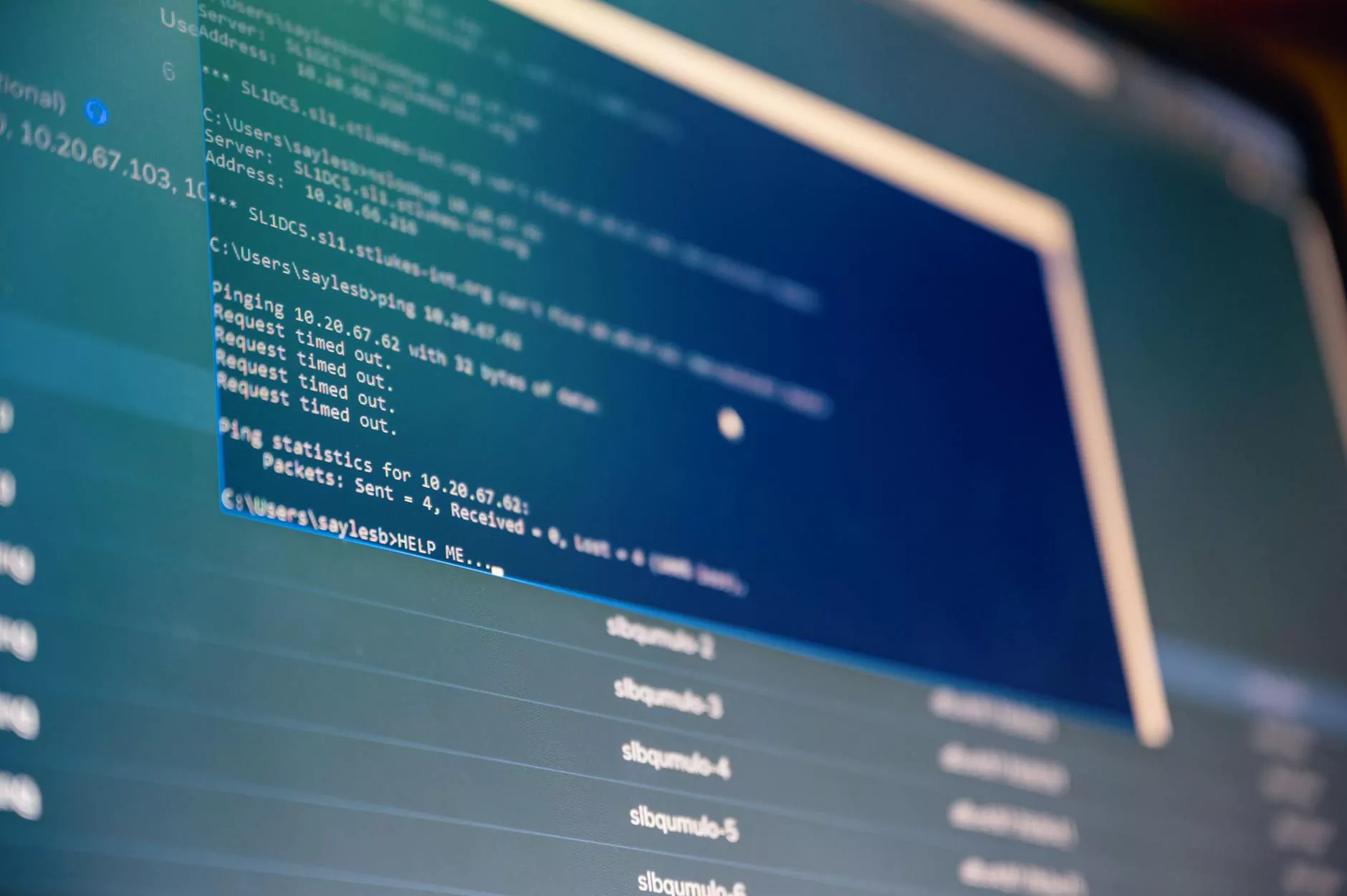

2. Validation and Submission

Once the application is prepared, our team will meticulously review and validate the information to ensure its accuracy. We will address any potential errors or discrepancies before proceeding with the submission process. Through our electronic filing system, we will securely submit your Form 1024 to the appropriate IRS office.

3. Tracking and Communication

After the submission, we understand the importance of keeping you informed about the progress of your application. Our team will diligently track the status of your Form 1024 and promptly communicate any updates or requests for additional information from the IRS.

4. Expert Support

Throughout the entire electronic filing process, our experts will be available to address any questions or concerns you may have. We are committed to providing comprehensive support and ensuring a smooth and successful application for tax-exempt status.

Why Choose Ballard & Tronzo Bookkeeping-Tax Service?

At Ballard & Tronzo Bookkeeping-Tax Service, we specialize in assisting non-profit organizations with their tax-related needs. Our dedicated team of professionals has a deep understanding of the complexities involved in the electronic filing of Form 1024. Here's why you should choose us:

1. Experience and Expertise

With years of experience in the industry, our team has extensive knowledge in navigating the nuances of non-profit tax regulations. We stay updated with the latest developments to ensure accurate and compliant filings.

2. Personalized Service

We value the unique requirements of each non-profit organization we serve. Our personalized approach allows us to tailor our services to meet your specific needs, ensuring a customized, efficient, and effective filing process.

3. Timely Assistance

Time is of the essence when it comes to securing tax-exempt status for your non-profit. We understand the importance of meeting deadlines and strive to provide timely assistance, minimizing delays and maximizing efficiency.

4. Transparent Communication

Our team believes in transparent communication throughout the entire process. We will keep you informed at every stage, providing updates, clarifications, and addressing any concerns along the way.

5. Cost-Effective Solutions

We offer competitive pricing without compromising on the quality of our services. Our cost-effective solutions aim to provide value for your investment while helping your non-profit organization achieve its goals.

Contact Us

Ready to embark on the electronic filing journey for your non-profit organization's Form 1024? Don't hesitate to get in touch with Ballard & Tronzo Bookkeeping-Tax Service. Our team of experts is here to provide the support and guidance you need for a successful application.

Call us now at 555-123-4567 or email us at [email protected]. Take the first step towards securing your non-profit's tax-exempt status today!