Investing Archives - Page 2 of 2

Blog

Overview of Investing

As an investor, making informed decisions is crucial for long-term success. At Ballard & Tronzo Bookkeeping-Tax Service, we understand the importance of solid investment strategies and the impact they have on both businesses and consumers. In this investing archive, we delve into various aspects of investing, providing comprehensive and detailed information to help individuals navigate the complex world of investments.

Investment Strategies

Choosing the right investment strategy is key to achieving financial goals. Our expert team at Ballard & Tronzo Bookkeeping-Tax Service has outlined a range of effective investment strategies that cater to different risk appetites and financial objectives. From value investing to growth investing, we explore these strategies to enable you to make well-informed decisions based on your unique circumstances.

Value Investing

Built on the principles of identifying undervalued assets, value investing focuses on purchasing stocks or other assets at a discount to their intrinsic value. By carefully analyzing financial statements, industry trends, and market conditions, value investors can uncover hidden gems that have the potential to provide substantial returns in the long run.

Growth Investing

Growth investing, on the other hand, emphasizes investing in companies that demonstrate significant growth potential. These companies often prioritize reinvestment of profits into research and development, allowing them to expand their market share and revenue. By strategically identifying businesses with promising growth prospects, investors can position themselves to benefit from capital appreciation over time.

Income Investing

Income investing is a strategy that focuses on generating a steady stream of income through investments. Dividend stocks, bonds, and real estate investment trusts (REITs) are common avenues for income investors. By carefully selecting assets with consistent income-generating capabilities, investors can enjoy regular payouts that contribute to overall portfolio stability.

Index Funds and ETFs

Index funds and exchange-traded funds (ETFs) provide investors with the opportunity to diversify their portfolios by investing in a basket of assets rather than individual stocks. These funds typically track specific market indexes, allowing investors to gain exposure to a wide range of stocks or other assets without the need for extensive research. We explore the benefits and considerations of investing in index funds and ETFs to help you understand their potential impact on your investment strategy.

Risk Management and Diversification

Understanding risk and managing it effectively is essential for any investor. In this section, we discuss the significance of risk assessment and the importance of diversification in mitigating potential losses.

Assessing Risk

Before making investment decisions, it is essential to thoroughly assess and understand the associated risks. Factors such as market volatility, economic conditions, and industry-specific risks can significantly impact investments. Our team provides guidance on assessing risk from various angles, equipping you with the knowledge to make informed choices.

Diversification

Diversification is a risk management strategy that involves spreading investments across different asset classes, industries, and geographic regions. By diversifying investments, investors aim to minimize the impact of adverse events on their overall portfolio performance. We explore different diversification techniques and highlight their potential benefits to help you construct a robust investment portfolio.

Market Analysis and Insights

Keeping up with the ever-changing investment landscape is crucial for successful investing. Our market analysis and insights section provides regular updates on market trends, economic indicators, and industry-specific developments.

Economic Indicators

Understanding key economic indicators can aid in making informed investment decisions. We cover a range of economic indicators, such as GDP growth, inflation rates, and unemployment figures, explaining their significance and impact on different investment methods.

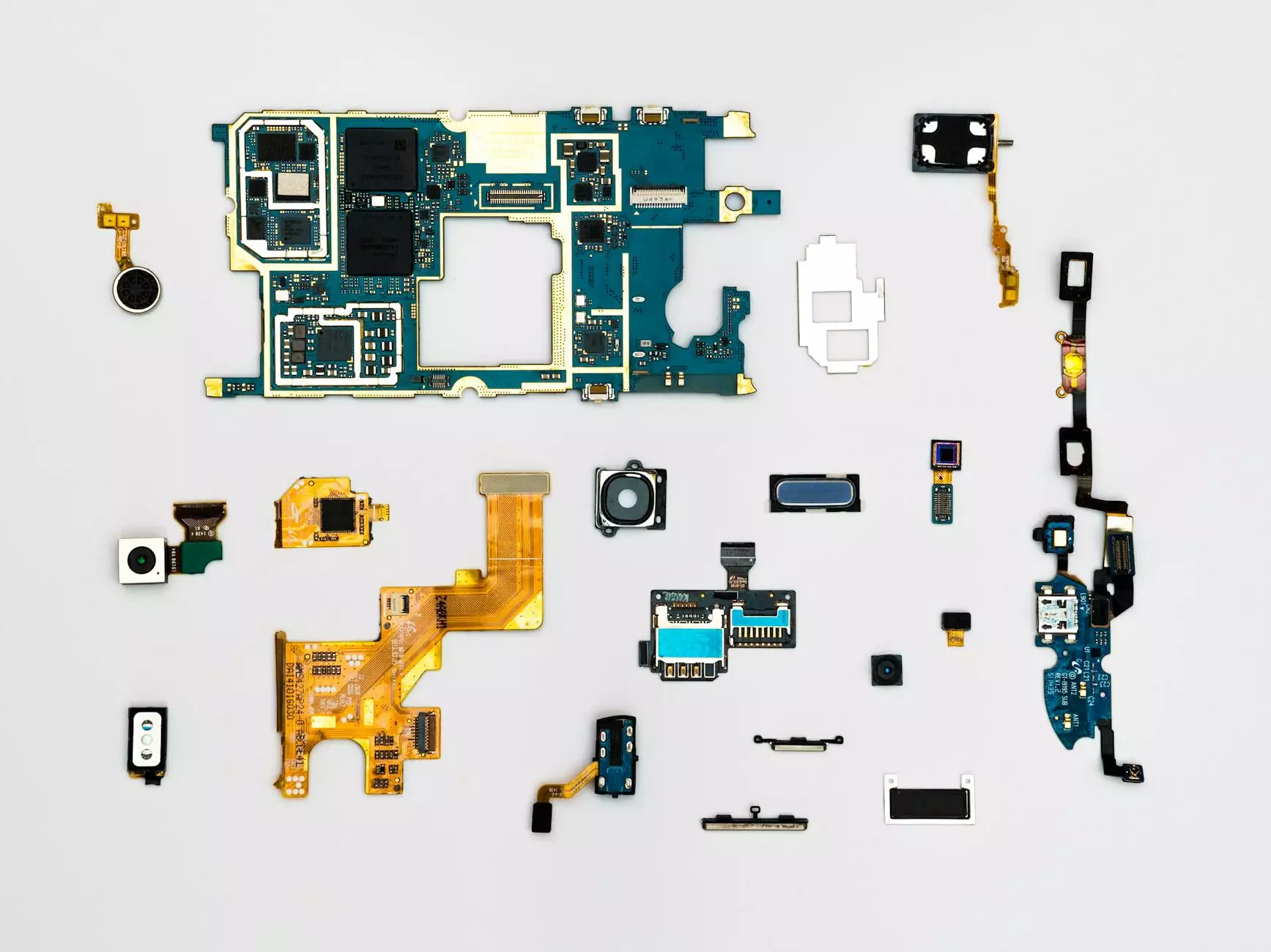

Industry-Specific Analysis

Investing in specific industries requires comprehensive analysis to identify potential risks and opportunities. Our industry-specific analysis delves into sectors such as technology, healthcare, real estate, and more, providing valuable insights to assist you in making industry-focused investment decisions.

Educational Resources

At Ballard & Tronzo Bookkeeping-Tax Service, we believe in empowering our clients with knowledge. In this section, we provide educational resources that cover a range of investment topics and concepts.

Investment Basics

For beginners looking to develop a strong foundation in investing, our investment basics resources offer an in-depth understanding of core concepts such as asset allocation, risk tolerance, and investment vehicles.

Advanced Investment Strategies

For seasoned investors seeking more advanced strategies, our advanced investment strategies section provides detailed insights into complex investment vehicles and techniques such as options trading, hedge funds, and private equity.

Personal Finance and Investing

Managing personal finances effectively is vital in supporting successful investing. Our personal finance and investing resources offer practical tips and guidance on budgeting, debt management, and goal setting to help you align your financial decisions with your investment objectives.

Conclusion

As you navigate the investing landscape, Ballard & Tronzo Bookkeeping-Tax Service is here to guide you every step of the way. With our comprehensive investing archives, you have access to rich and detailed information that can equip you with the knowledge and insights necessary to make well-informed investment decisions. Start exploring our archives today and unlock the potential of your investments.